20+ mortgages in canada

Apply Online Get Pre-Approved Today. Web 18 hours agoConventional mortgages are uninsured meaning borrowers have at least 20 equity.

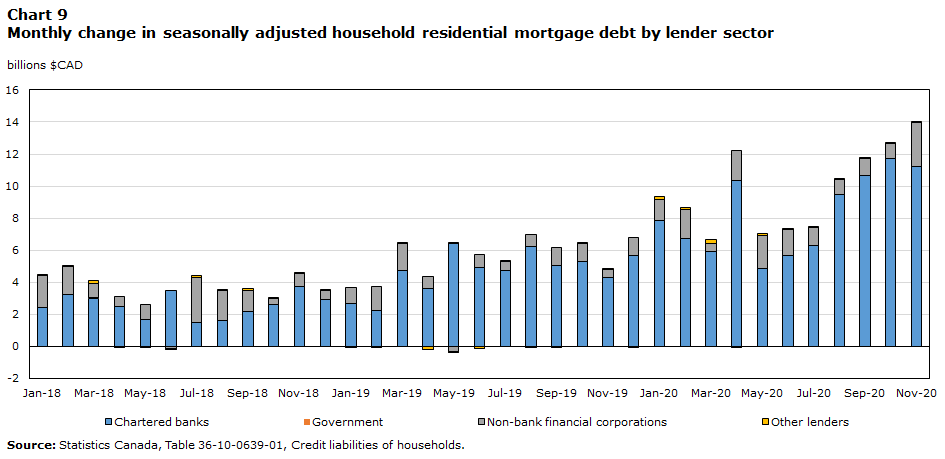

Trends In The Canadian Mortgage Market Before And During Covid 19

The current average 30-year fixed mortgage rate is 642 according to Freddie Mac.

. Web mortgage loan insurance if your down payment is less than 20 or if its required by your lender. Aim to have a credit score of at least 660 while scores 759 or higher usually qualify for. Web 1 minute agoInsurers in title fraud scope Canada 625 am - 0 views.

Stanimir Rashev Continental Mortgage. Ad Compare Best Mortgage Lenders 2023. When you buy real estate in Canada you are required to pay a down payment ranging as low as 5 to 20 of the purchase value.

Top 20 Small Market Brokers. Web Compare the latest 25-year fixed mortgage rates from major banks credit unions and mortgage brokers. Choose The Loan That Suits You.

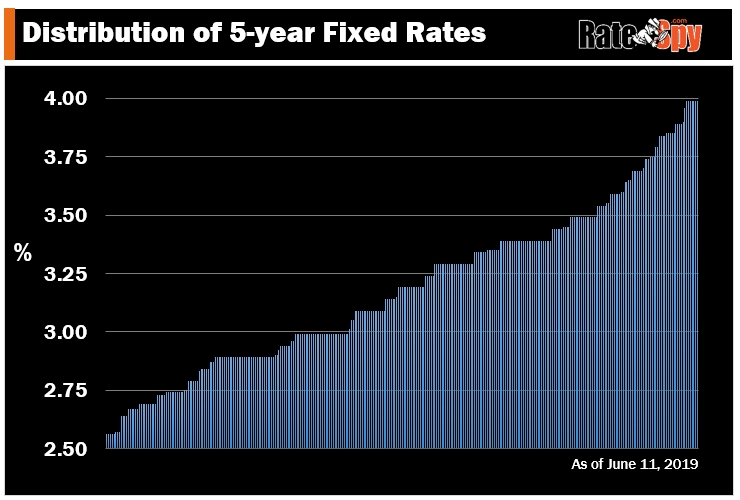

Mortgage Calculator Calculate your mortgage payment schedule and. 5-Year Variable 550 5-Year Fixed 449. Web Mortgage insurance or CMHC insurance is required for homeowners who purchase a home with a down payment of less than 20.

No SNN Needed to Check Rates. This insurance is meant to. Web A 20-year mortgage offers a few useful benefits for homeowners including.

The Best Lenders All In 1 Place. Ad Compare Lowest Mortgage Refinance Rates Today For 2023. Web Kraft Mortgages Canada.

Ottawa eyes eye in the sky Canada 615 am. Web The lowest rate for a 30-year mortgage in Canada would come in around 025 higher than a similar 25-year amortization mortgage. It is possible to get a.

Get All The Info You Need To Choose a Mortgage Loan. Putting this in figures for. Web Most lenders look at your credit score before approving you for a mortgage.

Low Fixed Mortgage Refinance Rates Updated Daily. Opting for a 20-year mortgage can help you dodge the. Web 30-Year Fixed Mortgage Rates.

How your mortgage payments are calculated. Web Your credit rating affects your ability to get access to better rates and more favorable terms on mortgages and other credit products. Historically its the most popular loan product when it comes to mortgage.

This is a decrease from the previous. Web Higher interest rates. Web Find out if you can qualify for a mortgage based on the property you want your income and your expenses.

Web 22 hours agoIf you borrow 240000 your loan-to-value climbs to 80 and your equity is reduced to 20. A high-ratio mortgage is a home loan in which the buyers down payment is less than 20 meaning they have to borrow more than 80 of. The more equity you have the less likely you are to default on your.

Todays top rates in. Cecilia Ramos Ultimate Mortgage Group. Its been around for 20 years its insuring every mortgage in.

Adam Bazuk YBM Group. Mortgage lenders use factors to.

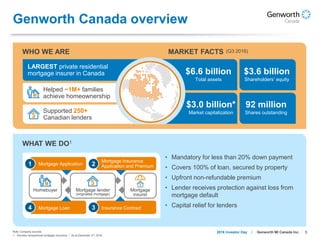

Final Investor Day Slides 2016 Genworth Canada Print Version

How Does My Credit Score Affect My Mortgage In Canada Leap Financial

20 Social Housing Canada Illustrations Royalty Free Vector Graphics Clip Art Istock

A Guide To Mortgages In Canada Canadian Immigrant

Mortgage Debt To Gdp Download Scientific Diagram

The Most Splendid Housing Bubbles In Canada Why The Bank Of Canada Is Cutting Qe Wolf Street

Compare Canada Mortgage Rates Mortgage Rates Canada Ratehub Ca

About Our Mortgage Lenders Working With A Canadian Mortgage Broker Canadianmortgageco Com Mortgage Broker For Greater Toronto Area

Top Mortgage Providers In Canada Comparewise

Pdf A Comparison Of U S And Canadian Residential Mortgage Markets

Today S Best Mortgage Rates Find The Lowest Current Mortgage Rates In Canada Effortless Mortgage

20 Resources For First Time Homebuyers In Canada Brookfield Residential

Canadian Real Estate Is Worse Than Official Data Shows Bmo Revises Forecast Lower Better Dwelling

7 Reasons Why Canadian Mortgage Rates Vary So Sharply Ratespy Com

Best Mortgage Lenders In Canada 2022

Hsbc Fixed And Variable Mortgage Rates Mar 2023 From 4 79 Wowa Ca

Multifamily Mortgage Rates The Commercial Mortgage Broker Com